It could be to expand their business or launch new products to meet the increasing demand from the customers. While such news is often fulfilling, it can also lead to sleepless nights, and rightly so. The significant figures drop select box only determines rounding for the ratios themselves. Shareholder equity represents the value of the company’s assets minus its liabilities, indicating the amount owned by shareholders. A lower D/E ratio suggests a company is relying more on its own assets and may be in a less leveraged position.

Investments

- A company with a D/E ratio greater than 1 means that liabilities are greater than shareholders’ equity.

- Short-term debt consists of liabilities that can be paid within a year’s time.

- This ratio can guide strategic decisions about leveraging debt, issuing equity, and managing financial risk.

- The significant figures drop select box only determines rounding for the ratios themselves.

- Company B has quick assets of $17,000 and current liabilities of $22,000.

Elevate your financial planning to ensure robust, balanced financial operations for your business. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. However, an ideal D/E ratio varies depending on the nature of the business and its industry because there are some industries that are more capital-intensive than others.

How confident are you in your long term financial plan?

The analysis of the D/E ratio can also be improved by including the profit performance, short-term leverage ratios and growth expectations. Use this calculator during financial reviews, investment analysis, or when assessing a company’s ability to meet its financial obligations. By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario.

Would you prefer to work with a financial professional remotely or in-person?

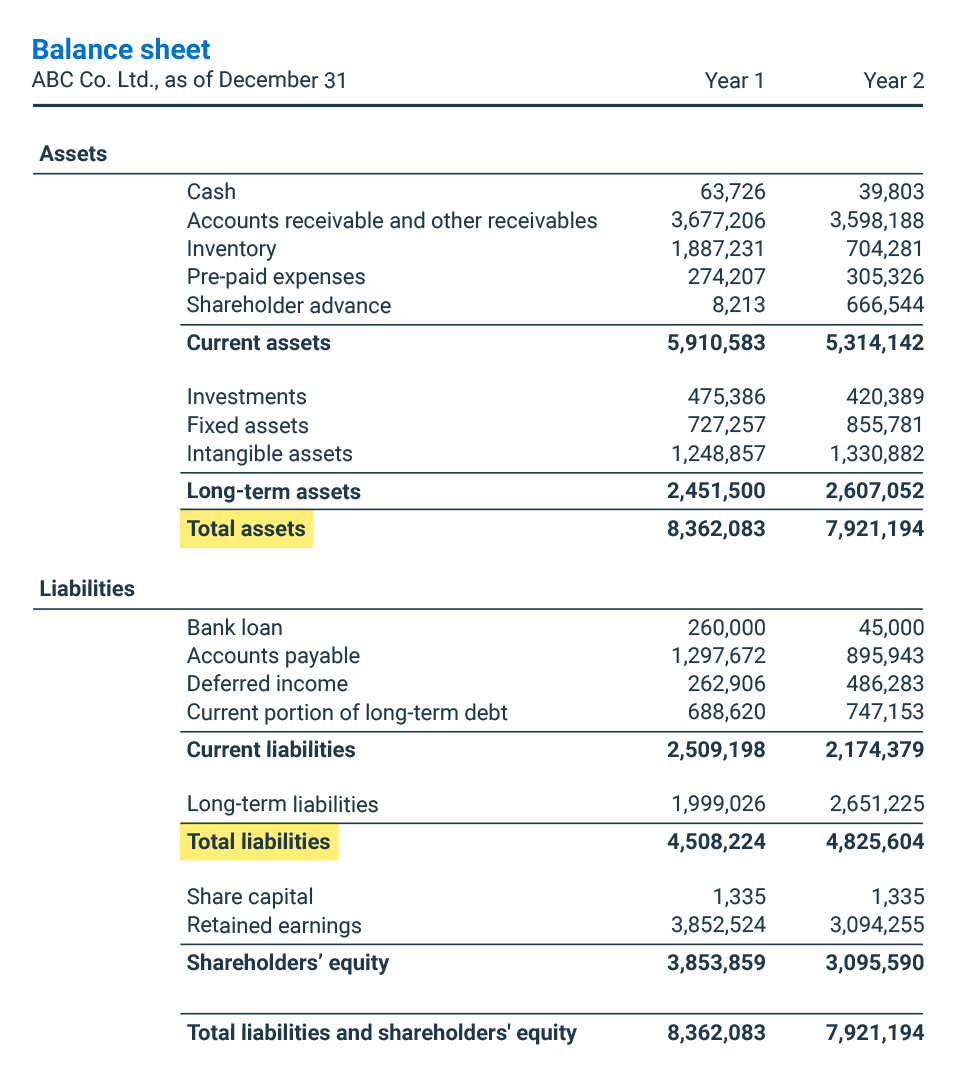

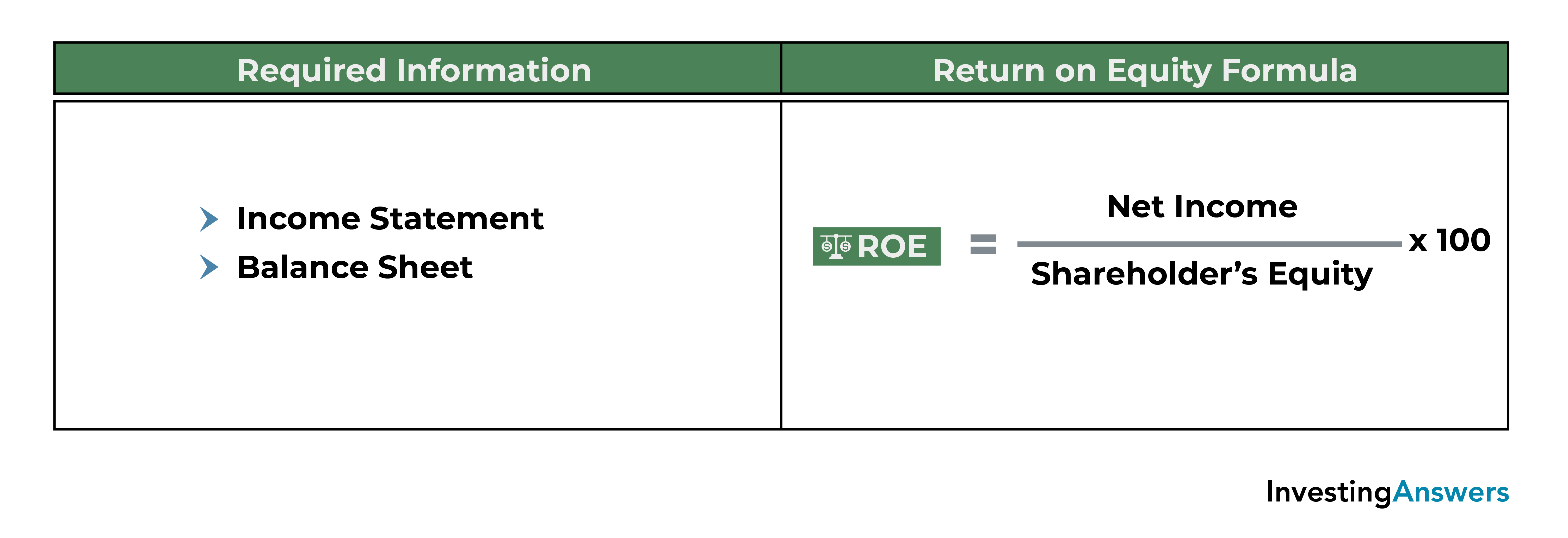

The current ratio reveals how a company can maximize its current assets on the balance sheet to satisfy its current debts and other financial obligations. The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. We can see below that for Q1 2024, ending Dec. 30, 2023, Apple had total liabilities of $279 billion and total shareholders’ equity of $74 billion. Or a seasoned entrepreneur who wants to take your company to the next level of growth? Either way, tracking financial ratios can help you analyze your company’s financial position and help you make more informed business decisions.

D/E calculates the amount of leverage a company has, and the higher liabilities are relative to shareholders’ equity, the more leveraged the company is. Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky. For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations. However, since they have high cash flows, paying off debt happens quickly and does not pose a huge risk to the company.

Accounting Services

Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio. This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons.

Using excel or another spreadsheet to calculate the D/E is relatively straightforward. First, using the company balance sheet, pull the total debt amount and the total shareholder equity amount, and enter these numbers into adjacent cells (e.g. E2 and E3). A lower debt-to-equity ratio means that investors (stockholders) fund more of the company’s assets than creditors (e.g., bank loans) do. It is usually preferred by prospective investors because a low D/E ratio usually indicates a financially stable, well-performing business.

Upon plugging those figures into our formula, the implied D/E ratio is 2.0x. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Our team is ready to learn about your business and guide you to the right solution. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

Ultimately, the D/E ratio tells us about the company’s approach to balancing risk and reward. A company with a high ratio is taking on more risk for potentially higher rewards. In contrast, a company with a low ratio is more conservative, which might be more suitable for its industry or stage of development. Considering the company’s context and specific circumstances when interpreting this ratio is essential, which brings us to the next question. So while the debt-to-equity ratio is not perfect, the others are not perfect either. That is why it is advantageous for businesses and financial institutions to pay attention to the different ratios.

When a company is not making enough profits, it will still have to repay its loans. If the business owners cannot make sales as expected, the company flat bonus pay calculator go bankrupt. There comes a time in the lives of small creative business owners when they have to consider raising capital from the market.